Are you striving for a successful career and financial freedom, but feel overwhelmed by the complexities involved? You’re not alone. Navigating the journey to professional success and financial stability can be challenging, filled with uncertainties and decisions that can impact your future.

But here’s the good news: You have the power to shape your destiny.

At Life Tree Planner, we understand the challenges you face, and we’re here to guide you through every step of the way. With years of expertise in career development and wealth management, we’ve helped countless individuals like you achieve their professional and financial goals.

In this comprehensive guide, we will cover:

- The universal principles that underlie both career and financial success

- How to align your career with your financial aspirations

- Practical strategies for continuous improvement and adapting to changes

Ready to take control of your career and wealth? Continue reading to discover how you can unlock your full potential and achieve a life of success and financial security.

By following our expert advice, you’ll be on your way to mastering the art of career and wealth management, leading to a fulfilling and prosperous future.

- 1. Universal Principles for Career and Wealth Success

- 2. How Career Planning Sets You Up for Financial Success

- 3. Finding Your True Calling: Aligning Passion with Paycheck

- 4. The Importance of Patience, Long-Term Thinking, and Career Longevity

- 5. The Interconnection Between Career, Health, and Finances

- 6. How to Transition into a Career You Love

- 7. Building a Sustainable Career: Balancing Money and Passion

- 8. The Role of Education, Knowledge, and Lifelong Learning in Success

- 9. Proven Strategies for Career Development and Networking

- 10. Financial Literacy and Entrepreneurship Basics

- 11. Staying Ahead of Industry Changes and Adapting to New Trends

- 12. Building and Maintaining a Positive Company Culture

- 13. Balancing Ambition with Well-Being: Work-Life Balance Tips

- 14. The Importance of Giving Back and Social Responsibility

- 15. Effective Leadership: The Key to Career Advancement

- 16. The Power of Mentorship in Career Growth

- 17. Navigating Career Challenges and Overcoming Setbacks

- 18. Balancing Risk and Reward in Financial Decisions

- 19. Creating a Financial Safety Net

- 20. Investment Strategies for Long-Term Wealth Accumulation

- 21. The Role of Technology and Innovation in Career and Wealth Management

- 22. The Impact of Globalization on Career and Financial Opportunities

- 23. Sustainable Wealth: Ethical Investing and Socially Responsible Careers

- 24. The Importance of Financial Independence and Early Retirement Planning

- 25. Preparing for the Future: Setting Long-Term Career and Financial Goals

- 26. Career and Wealth Management Across Life Stages

- For Teenagers Exploring Career Paths

- For University Students Preparing for the Workforce

- For Professionals Seeking a Career Change

- For Individuals Looking to Advance in Their Current Careers

- For Mid-Career Professionals Wanting to Reignite Growth

- For Those Planning for Retirement and Financial Independence

- Career and Wealth Management: A Recap

1. Universal Principles for Career and Wealth Success

At the heart of every success story are universal principles that remain consistent regardless of industry or individual circumstances. These principles include:

- Setting Clear Goals: Define what success looks like for you, both in your career and financially. Goals provide direction and purpose.

Here’s a list on how to Set Clear Goals:

- Define Your Objective: Be specific about what you want to achieve.

- Make Goals Measurable: Include clear criteria to track progress.

- Set Realistic Deadlines: Assign a timeframe for achieving each goal.

- Break Down Larger Goals: Divide them into smaller, actionable steps.

- Write Down Your Goals: Documenting your goals makes them tangible and trackable.

- Maintaining a Strong Work Ethic: Consistent effort and dedication are essential for both career growth and financial stability.

Here are 5 tips for maintaining a strong work ethic:

- Set Clear Goals: Define what you want to achieve and focus on your objectives.

- Stay Organized: Plan your tasks and prioritize your work.

- Be Consistent: Show up on time and deliver quality work consistently.

- Embrace Challenges: Face difficulties with determination and a positive attitude.

- Seek Feedback: Regularly ask for input to improve and grow.

- Continuous Learning: In a rapidly changing world, staying updated with new skills and knowledge is crucial.

Here’s a list on how to have continuous learning:

- Set Learning Goals – Identify skills or knowledge areas you want to develop.

- Read Regularly – Dedicate time to books, articles, and journals.

- Take Online Courses – Enroll in courses that align with your interests or career.

- Attend Workshops and Seminars – Engage in hands-on learning and networking opportunities.

- Practice Reflection – Regularly review what you’ve learned and how it applies to your life or work.

- Disciplined Financial Planning: Budgeting, saving, and investing wisely lay the foundation for financial security.

Here are 6 steps for disciplined financial planning:

- Set Financial Goals: Define short-term and long-term financial objectives.

- Create a Budget: Track income and expenses to manage spending effectively.

- Build an Emergency Fund: Save 3-6 months’ worth of living expenses for unexpected situations.

- Prioritize Debt Repayment: Focus on paying off high-interest debts first.

- Invest Regularly: Allocate funds to investments for long-term growth.

- Monitor Progress: Review and adjust your financial plan regularly.

Checklist for Success

- Set SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals.

- Commit to lifelong learning.

- Develop a habit of saving and investing.

- Regularly review and adjust your financial plans.

See also Money Management: Your Guide to Budgeting, Expenses, and Financial Success

2. How Career Planning Sets You Up for Financial Success

Career planning is a critical component of financial success. By carefully aligning your career goals with your financial aspirations, you create a roadmap that leads to both professional growth and financial stability.

Steps to Align Career with Financial Goals

- Identify Career Opportunities with Growth Potential: Choose a path that offers long-term opportunities.

- Assess Your Skills and Interests: Ensure your career aligns with what you enjoy and are good at.

- Plan for Advancement: Strategize how to move up in your field, which will directly impact your earning potential.

3. Finding Your True Calling: Aligning Passion with Paycheck

When you find a career that aligns with your passions, your work becomes more than just a job—it becomes a fulfilling part of your life. Passion drives excellence, which often leads to financial rewards.

Tips for Aligning Passion with Career

- Explore Different Fields: Take time to discover what you truly enjoy.

- Seek Out Mentors: Learn from those who have successfully aligned their passions with their careers.

- Consider the Long-Term: Passion can sustain you through challenges, leading to both personal and financial fulfillment.

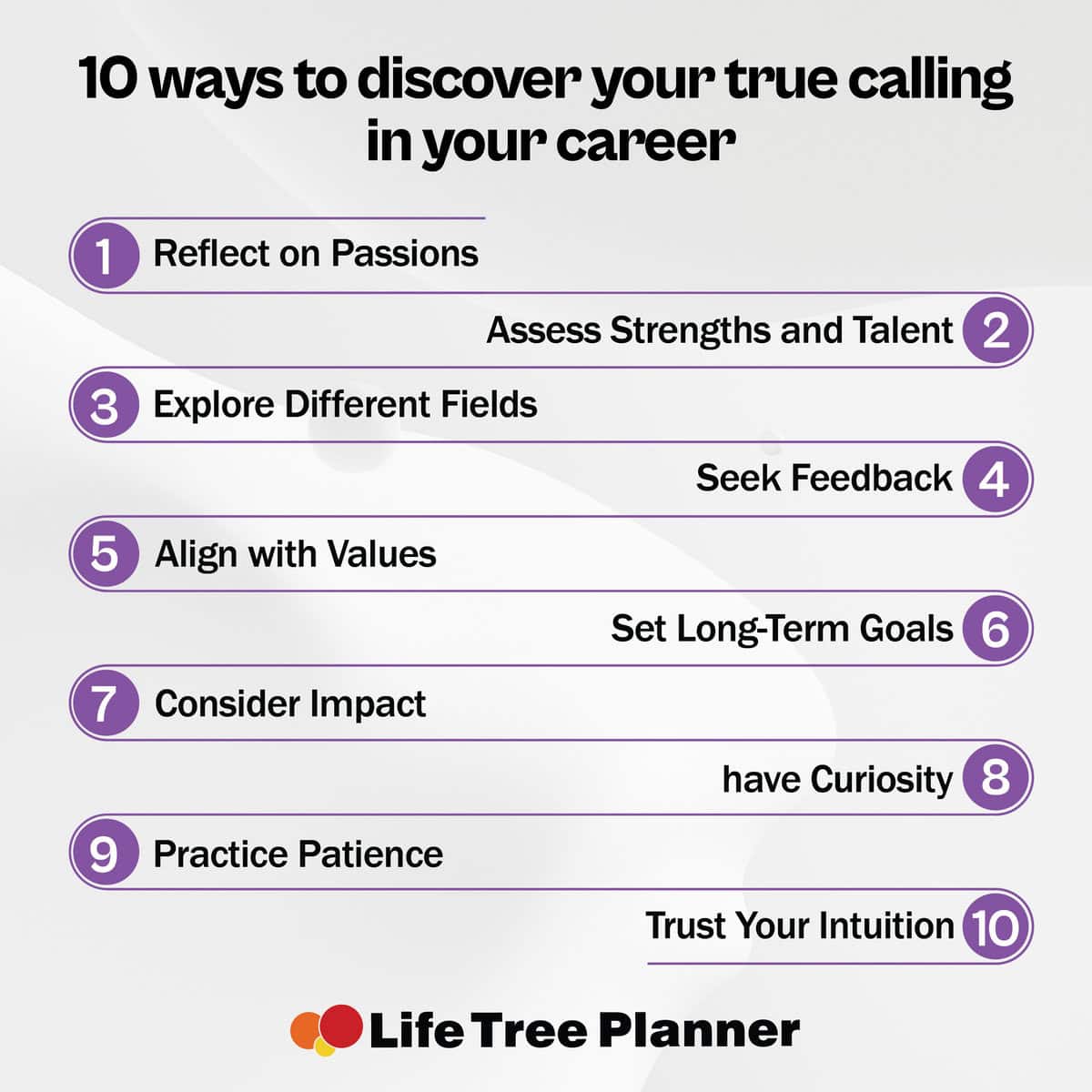

Here are 10 ways to discover your true calling in your career:

- Reflect on Passions: Identify activities and subjects that excite and inspire you.

- Assess Strengths and Talents: Consider what you excel at naturally.

- Explore Different Fields: Try internships, volunteering, or job shadowing in various industries.

- Seek Feedback: Ask mentors, colleagues, and friends for insights on your strengths and potential.

- Align with Values: Choose a career that matches your core beliefs and principles.

- Set Long-Term Goals: Define what success and fulfillment look like for you.

- Consider Impact: Think about how you want to contribute to society or make a difference.

- Have Curiosity: Stay open to learning new skills and exploring different paths.

- Practice Patience: Allow yourself time to experiment and find what truly resonates.

- Trust Your Intuition: Pay attention to what feels right and brings you joy.

4. The Importance of Patience, Long-Term Thinking, and Career Longevity

In a world that often prioritizes quick wins, patience and long-term thinking are essential for lasting success. Developing a career over time ensures longevity, which is key to financial stability.

Key Strategies for Career Longevity

- Focus on Skill Development: Continuously improve your skills to stay relevant.

- Avoid Burnout: Balance your workload to maintain long-term productivity.

- Invest in Relationships: Networking can open doors to new opportunities over time.

Here are 10 strategies for being more patient in life and career:

- Practice Mindfulness: Focus on the present moment.

- Set Realistic Expectations: Understand that progress takes time.

- Prioritize Self-Care: Regular rest and healthy habits improve patience.

- Break Down Goals: Tackle tasks in smaller steps.

- Accept Delays: See setbacks as learning opportunities.

- Manage Emotions: Recognize and control impatience triggers.

- Cultivate Gratitude: Focus on what’s going well.

- Listen Actively: Give full attention in conversations.

- Avoid Comparisons: Focus on your own journey.

- Stay Persistent: Keep working towards your goals.

5. The Interconnection Between Career, Health, and Finances

A balanced approach to career planning not only contributes to professional success but also supports overall well-being. Financial security reduces stress, allowing you to focus on both your health and happiness.

Checklist for a Balanced Life

- Prioritize physical and mental health.

- Ensure your work aligns with your life goals.

- Regularly assess and adjust your work-life balance.

6. How to Transition into a Career You Love

Making a career transition can be daunting, but with careful planning, you can turn your passion into a profitable career.

Steps for a Successful Career Transition

- Identify Your Strengths: What skills and passions do you bring to the table?

- Research Market Demand: Is there a need for your new career focus?

- Prepare Financially: Build a financial cushion to support you during the transition.

- Gain Relevant Experience: Start with part-time work or volunteering in your new field.

Here are 6 tips to help transition from a job you dread to a career you love:

- Identify Your Passions: Reflect on what excites and motivates you.

- Upgrade Skills: Acquire new skills relevant to your desired career.

- Start Networking: Connect with professionals in your target field.

- Find What Drives You: Understand your core motivations and values.

- Start Small: Explore your new field through side projects or part-time work.

- Seek Mentorship: Get guidance from someone who’s made a similar transition.

7. Building a Sustainable Career: Balancing Money and Passion

A sustainable career balances financial rewards with personal fulfillment. This approach ensures that you are not only earning a good income but also enjoying what you do.

Tips for Building a Sustainable Career

- Set Boundaries: Ensure work doesn’t consume your personal life.

- Pursue Opportunities that Align with Your Values: This increases job satisfaction.

- Reevaluate Your Career Regularly: Adjust as needed to stay aligned with your goals.

See also Personal Growth: Your Pathway to Personal Excellence

8. The Role of Education, Knowledge, and Lifelong Learning in Success

Lifelong learning is essential in today’s fast-paced world. It not only enhances your career prospects but also boosts your earning potential.

Strategies for Lifelong Learning

- Enroll in Online Courses: Stay updated with industry trends.

- Attend Workshops and Seminars: Gain new insights and network with professionals.

- Read Industry-Related Books and Articles: Keep your knowledge current.

9. Proven Strategies for Career Development and Networking

Networking and career development are inextricably linked. Building a strong professional network can lead to new job opportunities, mentorship, and career growth.

Checklist for Effective Networking

- Attend industry events.

- Engage with professionals on LinkedIn.

- Offer value before asking for help.

Tips for Career Development

- Set career milestones.

- Seek feedback regularly.

- Take on challenging projects.

10. Financial Literacy and Entrepreneurship Basics

Understanding financial literacy is key to both career and wealth management. For entrepreneurs, this knowledge is crucial for business success.

Key Financial Literacy Concepts

- Budgeting: Track your income and expenses.

- Investing: Understand the basics of investing to grow your wealth.

- Debt Management: Learn how to manage and reduce debt effectively.

Entrepreneurship Tips:

- Start with a Solid Business Plan: Outline your goals and strategies.

- Understand Cash Flow: Ensure your business remains solvent.

- Learn to Pitch: Master the art of pitching to potential investors.

11. Staying Ahead of Industry Changes and Adapting to New Trends

In today’s rapidly evolving job market, staying ahead of industry changes is crucial. Adapting to new trends ensures that you remain competitive and employable.

Steps to Stay Ahead

- Continuously Update Your Skills: Take courses or certifications as needed.

- Follow Industry Leaders: Stay informed about trends and changes.

- Be Open to Change: Embrace new technologies and methodologies.

12. Building and Maintaining a Positive Company Culture

A positive company culture is essential for long-term business success. It not only attracts and retains top talent but also fosters innovation and productivity.

Tips for Building a Positive Company Culture:

- Define Clear Values: Ensure they align with your company’s mission.

- Encourage Open Communication: Foster an environment where feedback is valued.

- Recognize and Reward Employees: Acknowledge hard work and achievements.

Here are 10 examples of positive work culture:

- Establish Trust: Foster a safe environment where employees feel secure in sharing ideas.

- Healthy Work Relationships: Promote respect and teamwork among colleagues.

- Prioritize Employee Wellbeing: Focus on mental and physical health with wellness programs.

- Forgive Mistakes: View errors as learning opportunities, not reasons for blame.

- Encourage Communication: Ensure open communication at all levels for a collaborative atmosphere.

- Strong Purpose and Values: Align daily operations with the company’s mission.

- Recognize Good Work: Regularly reward and acknowledge employee contributions.

- Effective Leadership: Leaders should inspire and support their teams.

- Transparency: Share information openly to build trust.

- Collaboration: Encourage teamwork across departments for better results.

13. Balancing Ambition with Well-Being: Work-Life Balance Tips

Balancing ambition with well-being is key to sustaining a successful career over the long term. Work-life balance helps prevent burnout and ensures that you maintain the energy and motivation needed to achieve your goals.

Here are 10 tips for achieving work-life balance:

- Set Boundaries: Define clear work and personal time to avoid burnout.

- Prioritize Tasks: Focus on important tasks and delegate or eliminate non-essential ones.

- Take Breaks: Regular breaks improve productivity and reduce stress.

- Learn to Say No: Avoid overcommitting to maintain balance.

- Unplug After Work: Disconnect from work-related communication outside work hours.

- Schedule Personal Time: Prioritize activities that rejuvenate you, like hobbies or exercise.

- Use Time Management Tools: Plan your day effectively with calendars and task lists.

- Communicate with Your Employer: Discuss flexible work arrangements if needed.

- Seek Support: Lean on family, friends, or a mentor for guidance.

- Regularly Review and Adjust: Continuously assess and tweak your work-life balance strategies.

14. The Importance of Giving Back and Social Responsibility

Incorporating social responsibilities into your career and financial planning can lead to greater fulfillment and success.

Ways to Give Back

- Volunteer: Offer your time and skills to a cause you care about.

- Donate: Contribute financially to organizations that align with your values.

- Mentor: Help guide someone else in their career journey.

15. Effective Leadership: The Key to Career Advancement

Effective leadership is essential for career advancement. Whether you’re leading a team or a project, strong leadership skills can set you apart and propel you toward your goals.

Key Leadership Skills

- Communication: Clearly convey your vision and expectations.

- Empathy: Understand and support your team’s needs.

- Decision-Making: Make informed decisions quickly and confidently.

Checklist for Developing Leadership Skills:

- Seek feedback on your leadership style.

- Take on leadership roles in small projects.

- Learn from experienced leaders.

See also Wellness: Your Personal Success Guide

16. The Power of Mentorship in Career Growth

Mentorship plays a crucial role in career growth. Having a mentor provides guidance, support, and valuable insights based on their experience.

Finding and Working with a Mentor:

- Identify Potential Mentors: Look for individuals in your field who have achieved the success you aspire to.

- Build a Relationship: Connect with potential mentors and express your admiration for their work.

- Be Open to Feedback: Take your mentor’s advice seriously and apply it to your career.

17. Navigating Career Challenges and Overcoming Setbacks

Setbacks are a natural part of any career journey. Learning how to navigate challenges effectively can turn obstacles into opportunities.

Strategies for Overcoming Career Challenges

- Stay Resilient: Don’t let setbacks discourage you.

- Seek Solutions, Not Excuses: Focus on what you can do to improve the situation.

- Learn from Mistakes: Every challenge is an opportunity to grow.

Here are 5 professional strategies for overcoming setbacks in your career:

- Conduct a Post-Mortem Analysis: Systematically review what led to the setback to identify key areas for improvement.

- Leverage Professional Networks: Engage with mentors and industry contacts to gain insights and guidance.

- Reevaluate Career Objectives: Adjust your goals and strategies based on new information and experiences.

- Develop Resilience Skills: Invest in training or coaching to enhance your ability to cope with future challenges.

- Implement Strategic Planning: Create a revised career plan with clear milestones to track progress and ensure alignment with long-term goals.

18. Balancing Risk and Reward in Financial Decisions

Balancing risk and reward is essential in financial planning. Whether investing in stocks, starting a business, or making a major purchase, understanding the risks and potential rewards can guide you toward better decisions.

Tips for Balancing Risk and Reward

- Diversify Investments: Don’t put all your eggs in one basket.

- Research Thoroughly: Understand what you’re getting into before making a decision.

- Consult with Experts: Seek advice from financial planners or mentors.

19. Creating a Financial Safety Net

A financial safety net is crucial for peace of mind. It ensures that you’re prepared for unexpected expenses or emergencies, which is an essential part of wealth management.

Steps to Build a Financial Safety Net

- Emergency Fund: Save at least 3-6 months’ worth of living expenses.

- Insurance: Ensure you have adequate health, life, and property insurance.

- Avoid High-Interest Debt: Pay off credit cards and other high-interest debt quickly.

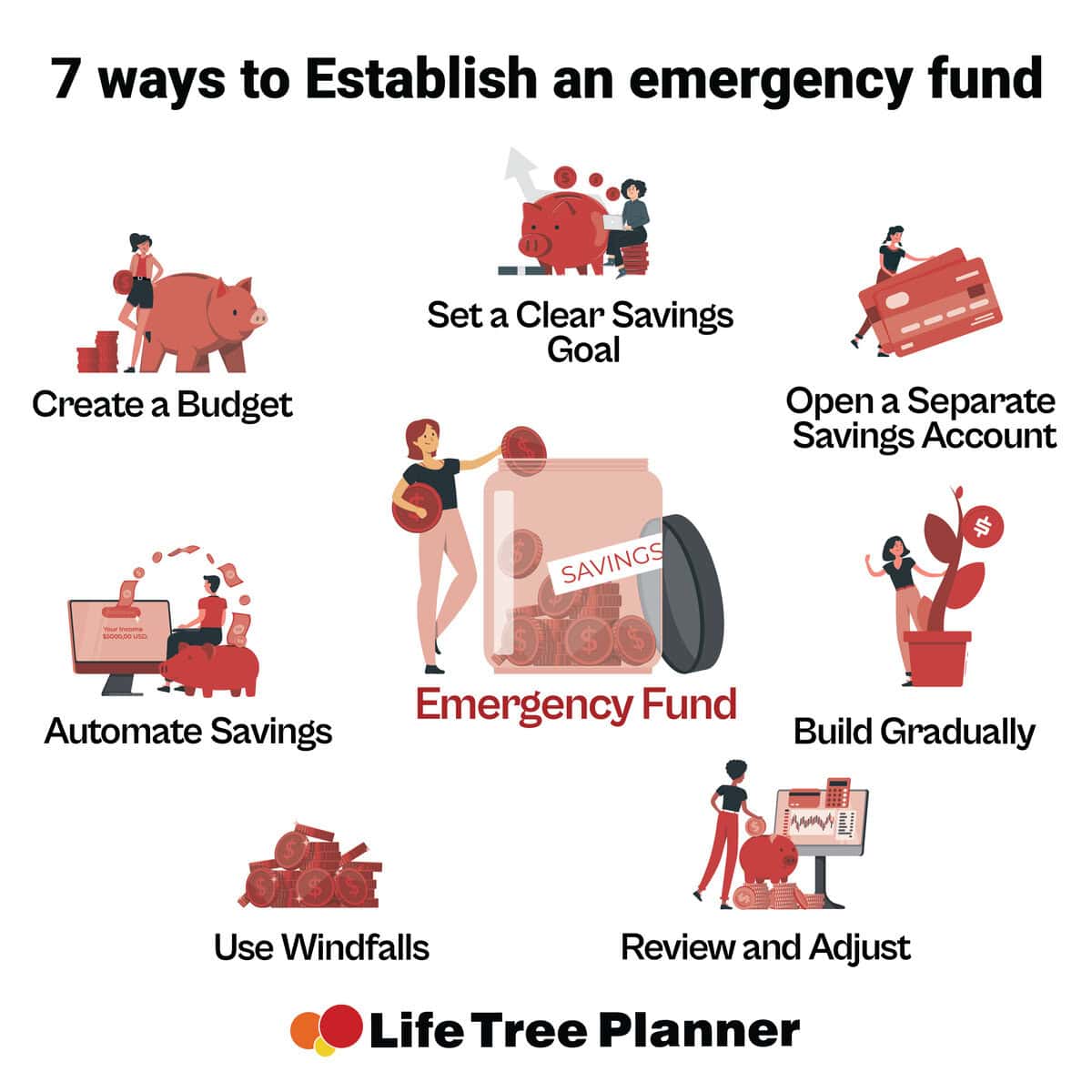

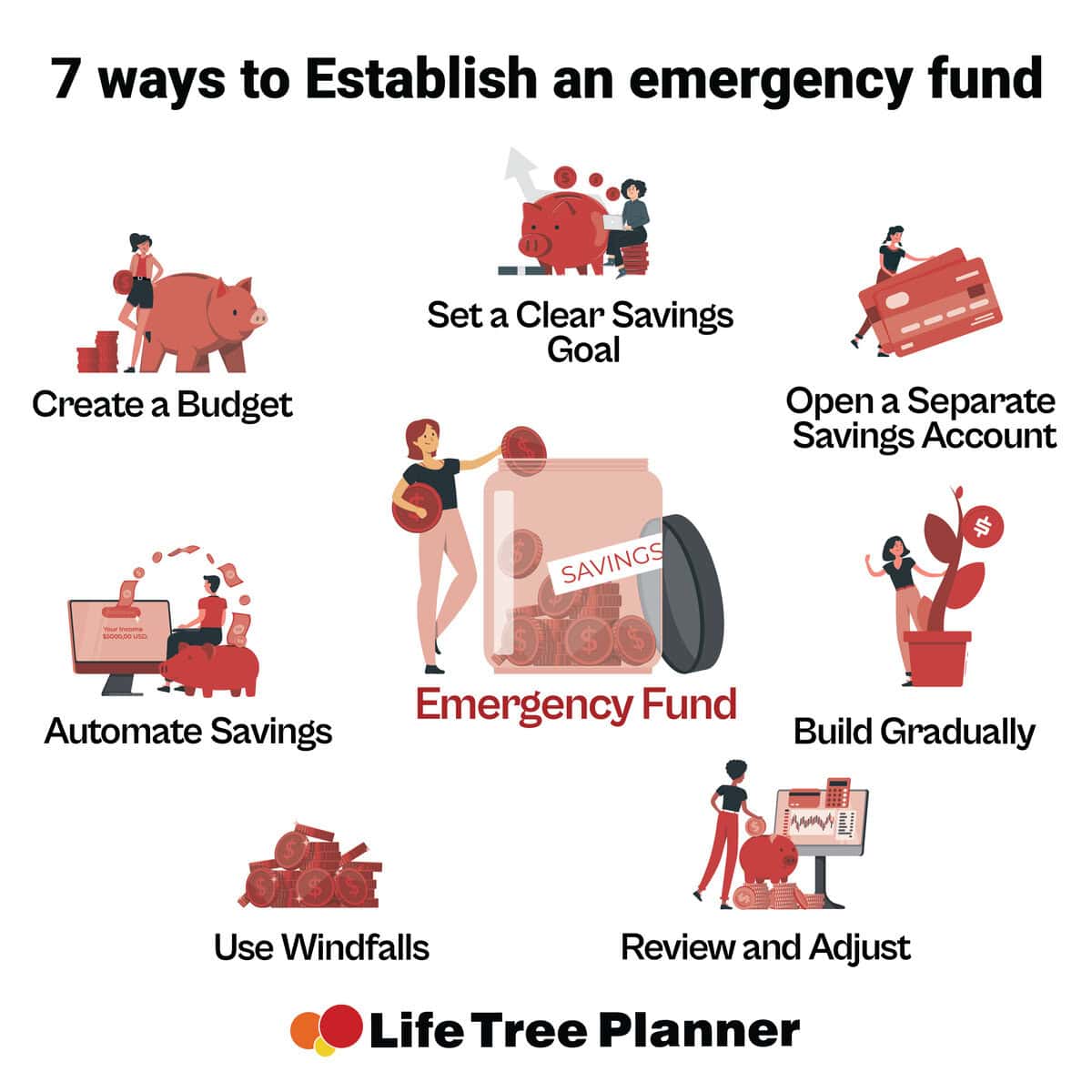

Here’s a list on how to establish an emergency fund:

- Set a Clear Savings Goal: Determine the amount you need to cover at least 3-6 months of expenses.

- Create a Budget: Track your income and expenses to identify areas where you can cut back and save.

- Open a Separate Savings Account: Use a dedicated account for your emergency fund to avoid mixing it with other savings.

- Automate Savings: Set up automatic transfers from your checking account to your emergency fund regularly.

- Build Gradually: Start with small, manageable amounts and increase contributions as your financial situation improves.

- Use Windfalls: Allocate bonuses, tax refunds, or unexpected income directly to your emergency fund.

- Review and Adjust: Periodically reassess your fund and savings goals to ensure they align with your current needs and expenses.

20. Investment Strategies for Long-Term Wealth Accumulation

Investing is a powerful tool for long-term wealth accumulation. By starting early and choosing the right investment strategies, you can grow your wealth significantly over time.

Key Investment Strategies

- Start Early: The sooner you start investing, the more you’ll benefit from compound interest.

- Diversify: Spread your investments across different asset classes to reduce risk.

- Focus on Long-Term Goals: Avoid short-term speculation; think about the long-term growth potential.

Here’s a list of 10 investment techniques:

- Diversification: Spread investments across different asset classes.

- Dollar-Cost Averaging: Invest a fixed amount regularly.

- Index Investing: Use funds that track market indices.

- Value Investing: Buy undervalued assets with strong fundamentals.

- Growth Investing: Invest in high-potential growth stocks.

- Dividend Investing: Focus on stocks with regular dividend payments.

- Real Estate Investment: Invest in property or REITs for income and appreciation.

- Risk Management: Implement strategies to hedge against losses.

- Active Trading: Engage in frequent trades for short-term gains.

- Long-Term Holding: Buy and hold for extended periods for growth.

21. The Role of Technology and Innovation in Career and Wealth Management

Technology is revolutionizing career and wealth management. From AI-driven financial planning tools to online learning platforms, embracing technology can give you a competitive edge.

How to Leverage Technology

- Use Financial Apps: Track your expenses and investments.

- Take Online Courses: Learn new skills from the comfort of your home.

- Network Online: Use LinkedIn and other platforms to connect with professionals.

22. The Impact of Globalization on Career and Financial Opportunities

Globalization has opened up new career and financial opportunities. Understanding its impact can help you capitalize on global trends and expand your horizons.

Tips for Navigating Global Opportunities

- Learn a New Language: Increase your marketability in the global job market.

- Explore Remote Work: Consider opportunities that allow you to work from anywhere.

- Stay Informed: Keep up with global economic trends that could impact your career or investments.

23. Sustainable Wealth: Ethical Investing and Socially Responsible Careers

Ethical investing and socially responsible careers are increasingly important. As more people seek to align their financial and career goals with their values, these approaches are gaining traction.

How to Practice Ethical Investing

- Research Companies: Invest in businesses that align with your values.

- Consider ESG Funds: Environmental, Social, and Governance (ESG) funds focus on socially responsible investing.

- Stay Informed: Follow trends in ethical investing and adjust your portfolio accordingly.

24. The Importance of Financial Independence and Early Retirement Planning

Financial independence and early retirement planning are achievable goals with the right strategies. Planning early can help you retire comfortably and enjoy your golden years.

Steps to Achieve Financial Independence

- Maximize Retirement Contributions: Take full advantage of 401(k)s, IRAs, and other retirement accounts.

- Live Below Your Means: Save and invest the difference.

- Plan for Healthcare: Ensure you have a plan for healthcare expenses in retirement.

Here’s a list of 10 retirement techniques:

- 401(k) Contributions: Maximize contributions to employer-sponsored retirement accounts.

- IRA Investments: Utilize Individual Retirement Accounts (IRA) for tax advantages.

- Roth IRAs: Invest in Roth IRAs for tax-free withdrawals in retirement.

- Diversified Portfolio: Build a balanced mix of stocks, bonds, and other assets.

- Regular Savings: Set aside a portion of income consistently for retirement.

- Employer Matching: Take full advantage of employer match contributions.

- Retirement Planning: Create a detailed plan for retirement income and expenses.

- Annuities: Consider annuities for guaranteed income streams.

- Social Security Maximization: Strategize the optimal time to start Social Security benefits.

- Health Savings Accounts (HSAs): Use HSAs to save for medical expenses with tax benefits.

25. Preparing for the Future: Setting Long-Term Career and Financial Goals

Setting long-term goals is crucial for both career and financial success. These goals give you direction and help you stay focused on what truly matters.

Tips for Setting Long-Term Goals

- Be Specific: Clearly define what you want to achieve.

- Break Down Your Goals: Divide them into smaller, manageable steps.

- Review Regularly: Regularly assess your progress and adjust your plans as needed.

See also Setting Goals at Work: 7 Proven Strategies for Your Success

26. Career and Wealth Management Across Life Stages

As you progress through different stages of life, both your career aspirations and financial strategies will naturally evolve. Understanding how to manage these changes is crucial for achieving long-term success and financial security. Below is a more detailed breakdown of how to navigate career and wealth management at each key life stage:

For Teenagers Exploring Career Paths

Action Plan: Self-Discovery and Exploration

- Identify Strengths, Interests, and Values:

- Self-Assessment Tools: Use career aptitude tests and personality assessments to understand your natural strengths and preferences.

- Reflection: Write down your passions, hobbies, and what you enjoy doing in your free time. This can help guide your career choices.

2. Explore Career Options:

- Research: Investigate various industries and job roles that align with your interests and strengths. Use online resources, like the Bureau of Labor Statistics’ Occupational Outlook Handbook, to learn about job outlooks and required skills.

- Job Shadowing: Spend a day or more shadowing professionals in careers of interest to gain firsthand experience.

- Part-Time Jobs/Volunteering: Gain practical experience and insight into different fields by working part-time or volunteering.

3. Develop Foundational Skills:

- Academic Focus: Concentrate on subjects that interest you and could be relevant to your future career. Excel in these areas to build a strong academic foundation.

- Soft Skills: Develop essential soft skills like communication, teamwork, and problem-solving through group activities, sports, or leadership roles in school.

Checklist for Teenagers:

- [ ] Take a career aptitude test.

- [ ] Research 3-5 careers of interest.

- [ ] Arrange job shadowing or informational interviews.

- [ ] Secure a part-time job or volunteer in a relevant field.

For University Students Preparing for the Workforce

Action Plan: Skill Building and Networking

- Gain Practical Experience:

- Internships: Pursue internships related to your field of study. Internships not only provide practical experience but can also lead to job offers post-graduation.

- Part-Time Jobs: Work in roles that complement your studies or future career plans. Even unrelated jobs can help build transferable skills.

- Student Projects: Engage in university projects or competitions that allow you to apply your knowledge in real-world scenarios.

2. Build a Professional Network:

- Networking Events: Attend industry-related seminars, conferences, and career fairs. Don’t just attend—actively engage with professionals.

- LinkedIn: Create a LinkedIn profile that highlights your skills, education, and experience. Connect with peers, professors, and industry professionals.

- Mentorship: Seek out mentors who can provide guidance, advice, and potentially open doors to job opportunities.

3. Prepare for Job Applications:

- Resume and Cover Letter: Craft a professional resume and cover letter tailored to each job application. Emphasize relevant skills and experiences.

- Interview Practice: Participate in mock interviews through your university’s career services to build confidence and improve your interviewing skills.

Checklist for University Students:

- [ ] Complete at least one internship.

- [ ] Attend 3-4 networking events per semester.

- [ ] Create and regularly update your LinkedIn profile.

- [ ] Conduct at least two mock interviews.

For Professionals Seeking a Career Change

Action Plan: Strategic Planning and Skill Acquisition

- Evaluate Your Current Situation:

- Self-Reflection: Assess why you want to change careers. Is it due to lack of passion, job dissatisfaction, or seeking better financial prospects?

- Financial Readiness: Review your financial situation. Determine how much savings you’ll need to comfortably transition to a new career, considering potential periods of unemployment or reduced income.

2. Develop New Skills:

- Education and Training: Enroll in courses, certifications, or degree programs that align with your new career goals. Consider both traditional and online platforms like Coursera or Udemy.

- On-the-Job Learning: If possible, start learning new skills within your current role that can be applied to your new career path.

- Freelancing/Part-Time Work: Start freelancing or taking on part-time work in your desired field to build experience and a portfolio.

3. Plan a Gradual Transition:

- Networking: Connect with professionals in your target industry. Informational interviews can provide insights into the field and help build connections.

- Job Search Strategy: Apply for positions that are a step toward your desired role, even if they are lateral moves. These positions can serve as bridges to your ultimate career goal.

- Financial Safety Net: Save 6-12 months’ worth of living expenses to cushion the financial impact of a career change.

Checklist for Career Changers:

- [ ] Conduct a financial assessment.

- [ ] Complete relevant courses or certifications.

- [ ] Begin freelancing or part-time work in your new field.

- [ ] Build a network in your target industry.

For Individuals Looking to Advance in Their Current Careers

Action Plan: Professional Development and Leadership

- Invest in Continuous Learning:

- Advanced Certifications: Pursue industry-recognized certifications that enhance your expertise and marketability.

- Leadership Training: Participate in leadership development programs or workshops. These will prepare you for management roles and increase your influence within your organization.

- Advanced Degrees: Consider earning an advanced degree, such as an MBA, if it aligns with your career goals.

2. Build Strategic Relationships:

- Mentorship: Seek mentorship from senior leaders in your organization. Their guidance can help you navigate corporate structures and advance more quickly.

- Peer Networking: Develop strong relationships with your peers. These connections can lead to collaborative opportunities and increased visibility within your organization.

- Visibility: Take on high-visibility projects that align with your strengths. Success in these projects can lead to promotions and recognition.

3. Pursue Internal Growth Opportunities:

- Promotions: Express your interest in advancement opportunities during performance reviews. Be proactive in seeking out roles that align with your career goals.

- Lateral Moves: Don’t dismiss lateral moves that provide new experiences or broaden your skill set. These can be stepping stones to higher positions.

- Skill Enhancement: Continuously update your skills to stay relevant. This could involve learning new technologies or methodologies that are becoming critical in your industry.

Checklist for Career Advancement:

- [ ] Complete relevant certifications or advanced degrees.

- [ ] Establish a relationship with a mentor.

- [ ] Lead a high-visibility project.

- [ ] Regularly update your professional skills.

For Mid-Career Professionals Wanting to Reignite Growth

Action Plan: Reassessment and Strategic Pivoting

1.Reevaluate Career Goals:

- Self-Assessment: Reflect on your career journey and current satisfaction levels. Are you where you want to be? Identify any gaps between your current role and your long-term goals.

- Revised Career Plan: Update your career plan based on your reassessment. Set new, challenging goals that reignite your passion and drive.

2. Pivot Towards High-Growth Areas:

- Industry Research: Identify high-growth areas within your industry or related fields. Transitioning to these areas can provide renewed challenges and growth opportunities.

- Skill Development: Acquire the skills necessary to succeed in these emerging areas. This might involve additional training, certification, or education.

3. Explore Entrepreneurial Opportunities:

- Side Ventures: Consider starting a side business that aligns with your passions. This can provide an additional income stream and may eventually lead to full-time entrepreneurship.

- Consulting: Leverage your expertise by offering consulting services in your field. This allows you to continue growing while exploring different facets of your industry.

Checklist for Mid-Career Growth:

- [ ] Reassess and update your career goals.

- [ ] Identify and transition into a high-growth area.

- [ ] Consider starting a side business or consulting.

For Those Planning for Retirement and Financial Independence

Action Plan: Wealth Preservation and Legacy Planning

- Prioritize Saving and Investing:

- Retirement Accounts: Maximize contributions to retirement accounts, such as 401(k)s and IRAs. Take full advantage of any employer match programs.

- Diversification: Ensure your investment portfolio is diversified to manage risk as you approach retirement. Include a mix of stocks, bonds, and other income-generating assets.

- Catch-Up Contributions: If you’re over 50, take advantage of catch-up contributions to boost your retirement savings.

2. Develop Passive Income Streams:

- Real Estate: Invest in rental properties or Real Estate Investment Trusts (REITs) to generate ongoing passive income.

- Dividend Stocks: Focus on stocks that pay regular dividends, providing a steady income stream in retirement.

- Annuities: Consider purchasing annuities for guaranteed income during retirement.

3. Plan Your Legacy:

- Estate Planning: Work with an estate planner to ensure your assets are distributed according to your wishes. This includes creating a will, setting up trusts, and designating beneficiaries.

- Philanthropy: If giving back is important to you, consider setting up a charitable foundation or making planned gifts to causes you care about.

- Mentorship: Share your knowledge and experience by mentoring younger professionals. This not only leaves a legacy but also provides personal fulfillment.

Checklist for Retirement Planning:

- [ ] Maximize retirement account contributions.

- [ ] Diversify your investment portfolio.

- [ ] Develop multiple passive income streams.

- [ ] Complete estate planning with a professional.

Career and Wealth Management: A Recap

Your journey to career and financial success is unique, but with the right strategies, guidance, and mindset, you can achieve your goals. By understanding and applying the principles and strategies outlined in this guide, you’re setting yourself up for a life of fulfillment, security, and prosperity.

Are you ready to take control of your career and finances? Start implementing these tips today, and watch as you move closer to the success you’ve always dreamed of.

Success is within your reach—take the first step now.