Are you passionate about making a positive impact on the world but unsure where to begin? Starting a charity can feel overwhelming, but it doesn’t have to be. You have the power to create meaningful change, and we’re here to guide you through it.

As the hero of your cause, you’re not alone in this journey. We’ll help you navigate the steps to turn your vision into a reality.

In this article, we’ll cover 15 essential steps to start a charity, including defining your mission, registering your charity, raising funds, and ensuring legal compliance.

Follow these steps, and you’ll be well on your way to creating a lasting impact.

Ready to take the first step? Let’s start!

- What is a Charity Fund?

- Key Steps to Start a Charity Fund

- 1. Define Your Mission

- 2. Choose a Name

- 3. Decide on Your Legal Structure

- 4. Assemble a Board of Directors

- 5. Draft Your Charity Bylaws

- 6. Register Your Charity Fund

- 7. Obtain an EIN (Employer Identification Number)

- 8. Apply for Tax-Exempt Status

- 9. Comply with State Requirements

- 10. Open a Bank Account

- 11. Develop a Fundraising Plan

- 12. Maintain Legal Compliance

- 13. Promote Your Charity

- 14. Evaluate and Adapt

- 15. Seek Professional Advice

- Marketing Your Charity Fund

- How to Start a Charity Fund: A Recap

What is a Charity Fund?

A charity fund is a pool of money raised to support a charitable organization or cause. It helps raise money for charity and promotes social good. Charity funds may include public charities, private foundations, or endowment funds.

These funds often operate under tax-exempt status approved by the Internal Revenue Service (IRS). Donations are typically tax-deductible, benefiting both donors and recipients. Funds are managed through nonprofit corporations with proper financial statements for transparency.

A financial advisor may assist in fund management. To avoid toxic charity, funds must comply with legal guidelines set by government agencies. Organized charity ensures accountability and long-term impact.

See also 50 Life Goals List: Inspiring Ideas for a Fulfilling Life

Key Steps to Start a Charity Fund

1. Define Your Mission

Start by identifying the purpose of your charity fund. What specific cause do you want to support? Whether it’s education, healthcare, poverty, or animal welfare, having a clear mission provides focus.

It helps you create a roadmap and attract like-minded supporters. Write a simple mission statement that describes what you want to achieve and why it matters. This statement will guide all future decisions.

2. Choose a Name

Pick a name that represents your mission and vision. It should be memorable, clear, and relevant to your cause. Avoid names that are too complicated or already in use. Check local and national databases to confirm the name is available.

A good name makes your charity recognizable and builds trust with donors. It’s also important for branding and marketing purposes later.

3. Decide on Your Legal Structure

You need to decide how to legally structure your charity fund. Here are two common options:

- Charitable Trust: Managed by trustees to oversee donations and spending.

- Nonprofit Corporation: Offers more structure and legal protection for directors.

Each option has benefits depending on your goals and resources. Research the pros and cons or consult a lawyer to decide which structure fits best.

4. Assemble a Board of Directors

A board of directors is responsible for overseeing your charity’s operations. Select people who share your passion and bring useful skills like finance, law, or fundraising. A diverse and committed board can help you make strategic decisions.

The board will provide guidance, governance, and accountability to ensure the charity’s success. Hold regular meetings to stay aligned with your goals.

5. Draft Your Charity Bylaws

Bylaws are a set of rules that outline how your charity will operate. Include information about board roles, voting procedures, decision-making, and meetings.

Bylaws ensure everyone knows their responsibilities and keep the organization organized. You may need these for state registration and tax-exemption applications. They act as a “rulebook” for running your charity effectively and fairly.

6. Register Your Charity Fund

To make your charity legal, you need to file paperwork with your state government. This process usually involves submitting articles of incorporation. Requirements vary by state, so check your local guidelines.

Registering your charity fund gives it legal status, allowing you to operate, raise funds, and gain credibility with donors.

7. Obtain an EIN (Employer Identification Number)

An EIN is a tax ID number issued by the IRS. It’s essential for filing taxes, applying for tax-exempt status, and opening a bank account. You can apply for an EIN online for free. Think of it as your charity’s “social security number.”

It makes your organization official in the eyes of the IRS and banks.

See also How to Save Money: 30 Smart Strategies to Cut Costs

8. Apply for Tax-Exempt Status

To avoid paying federal taxes, you’ll need to apply for 501(c)(3) status with the IRS. Submit Form 1023 or 1023-EZ, depending on your charity’s size. Approval can take weeks or months.

With this status, donors can claim tax deductions for their contributions, which helps attract more support. Tax exemption also adds credibility to your charity.

9. Comply with State Requirements

Many states require additional registration if you plan to solicit donations. Research your state’s charity laws and regulations. This step ensures you operate legally and transparently.

Failure to comply can result in penalties or restrictions. Keeping up with state laws protects your charity and builds trust with donors.

10. Open a Bank Account

Once your charity fund is registered, open a dedicated bank account in its name. Use your EIN and official documents to set it up. A separate account makes it easier to manage finances, track donations, and report expenses.

It also ensures transparency and accountability. Avoid using personal accounts to prevent legal or financial confusion.

11. Develop a Fundraising Plan

Plan how you will raise money to support your cause. Fundraising options include:

- Grant applications

- Crowdfunding or online donation campaigns

- Charity events like auctions, walks, or dinners

A strong fundraising strategy is essential for long-term success. Set clear goals, research your target audience, and explore multiple income sources to ensure financial stability.

12. Maintain Legal Compliance

Charities must follow strict rules to stay compliant. File annual reports with the IRS and your state. Keep accurate financial records of donations and expenses. Renew licenses or registrations as required.

Legal compliance ensures your charity remains in good standing. It also increases transparency and donor confidence.

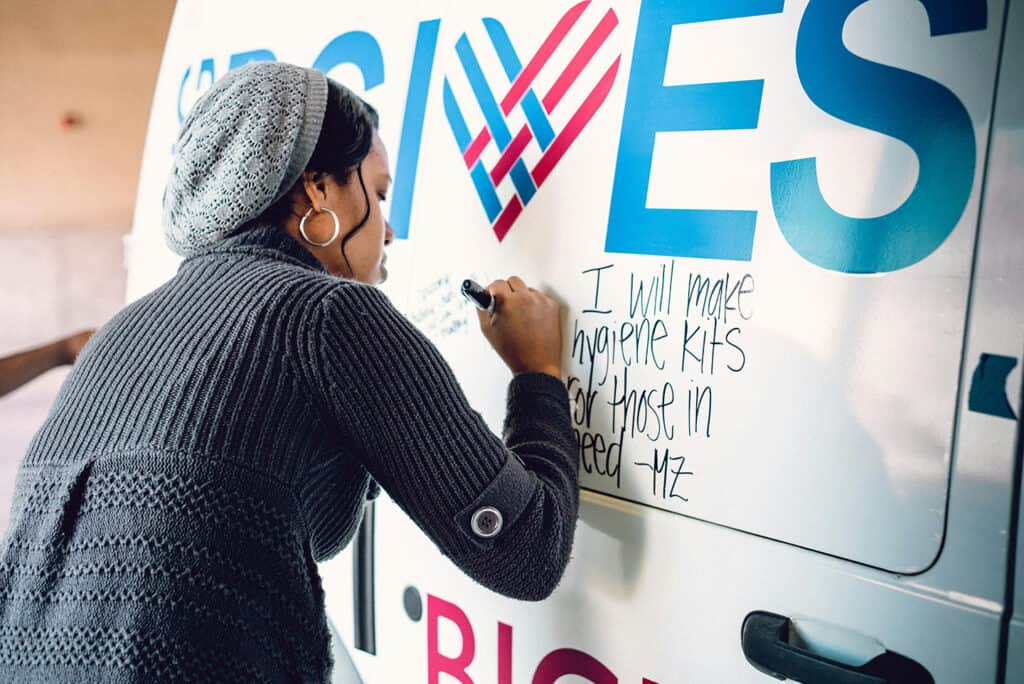

13. Promote Your Charity

Spread the word about your charity to raise awareness. Create a website, use social media, and attend community events. Effective promotion helps you reach more donors, volunteers, and supporters.

Share success stories, updates, and photos to show how donations make a difference. Marketing is essential for growing your charity’s impact.

14. Evaluate and Adapt

Regularly review your charity’s progress and impact. Are you meeting your goals? Analyze your fundraising efforts, expenses, and overall effectiveness. Collect feedback from your board, donors, and volunteers.

Be open to adapting your strategies. Continuous evaluation helps you improve and stay aligned with your mission.

15. Seek Professional Advice

Starting and managing a charity involves legal and financial complexities. Seek advice from attorneys, accountants, or nonprofit consultants. They can help with registration, tax exemption, and fundraising strategies.

Professionals ensure you follow the law and run your charity efficiently. It’s an investment that protects your charity’s future.

Marketing Your Charity Fund

Effective marketing of your charity fund ensures support and growth. Highlight your tax-exempt status and emphasize benefits like tax-deductible donations to attract donors. Collaborate with a charity event planner to organize engaging events.

Partner with private foundations, nonprofit organizations, and government agencies for credibility.

Keep accurate financial statements and promote transparency in financial and money management. Apply for charitable grants to secure funding. Share success stories from your charitable foundation. Streamline administrative tasks to focus on fundraising efforts.

Tips for Marketing:

- Build trust with tax-exempt documentation.

- Host events with a clear cause.

- Share progress reports and goals online.

- Partner with impactful organizations.

See also Social Responsibility Norm: 5 Key Points to Understand

How to Start a Charity Fund: A Recap

To finish your charity, finalize your business plan. Ensure your charity aligns with one of the 5 types of charity, like public safety or education. File for 501(c)(3) status through the Internal Revenue Service to gain tax-exempt status.

Work with a financial advisor to manage donations and plan for financial management. Partner with government agencies or private foundations to expand reach. Read books about charity for guidance.

Promote your nonprofit organization effectively to build awareness. Transparency about funds builds trust. Register your charity legally, and maintain compliance to retain tax-exempt benefits. With clear goals and consistent effort, your organization can grow and make a lasting impact.