How can you turn everyday moments into fun learning opportunities for your kids? Teaching children about money doesn’t have to be boring—it can be an adventure filled with engaging activities that build essential life skills.

From recognizing coins to budgeting for a big purchase, kids can gain financial literacy through play and hands-on experiences.

In this article, you’ll discover 20 creative money activities for kids of all ages.

After reading this article, you’ll discover 20 fun activities to help kids of all ages build essential money management skills in an engaging way.

Explore these ideas to instill money management skills and set your children up for financial success—all while having fun together!

Why Teach Kids About Money Early?

Teaching kids about money early builds essential life skills. Children learn how to save money, identify different coins, and handle paper money. Fun money activities help kids understand the value of earning and saving.

Financial literacy promotes smart money management and wise investing habits.

Lesson plans make complex topics simple, ensuring kids grasp important concepts like how to budget and spend wisely. These skills prepare them for financial independence. Early exposure also helps responsibilities, empowering kids to make informed decisions.

Encouraging kids to earn money through chores or tasks builds work ethics. Teaching these principles early lays the foundation for long-term success and financial security.

Creative Money Management Activities for Kids

5 Money Activities for Young Children (Ages 3-6)

1. Sorting Coins

This activity helps young children recognize and differentiate coins by size, color, and value. It builds basic counting skills and introduces them to the concept of money in a hands-on and interactive way. Parents can make it more engaging by creating sorting challenges or rewarding correct groupings with small incentives.

2. Toy Store Play

Setting up a pretend toy store allows kids to practice “buying” and “selling” with play money. It teaches basic transaction skills, decision-making, and counting. Parents can act as customers or cashiers, turning this playful activity into a fun and educational experience.

3. DIY Savings Jar

Decorating a savings jar makes saving exciting and visual for children. They can see their money grow over time, reinforcing the habit of saving. Parents can encourage kids to save for small goals, like a toy, to teach patience and reward.

4. Counting Games

Using coins or tokens in counting games introduces numbers in a tangible way. Kids can learn addition and subtraction with simple scenarios, such as “buying” items with a specific number of coins. It’s a playful way to build foundational math skills.

5. Piggy Bank Practice

A piggy bank introduces children to the idea of collecting and saving money. Encourage them to regularly deposit coins they receive and explain how saving small amounts can add up. Make it fun by setting short-term saving goals with small rewards.

See also Money Management for Seniors: 8 Key Steps to Secure Your Finances

5 Money Activities for Elementary Kids (Ages 7-10)

1. Board Games About Money

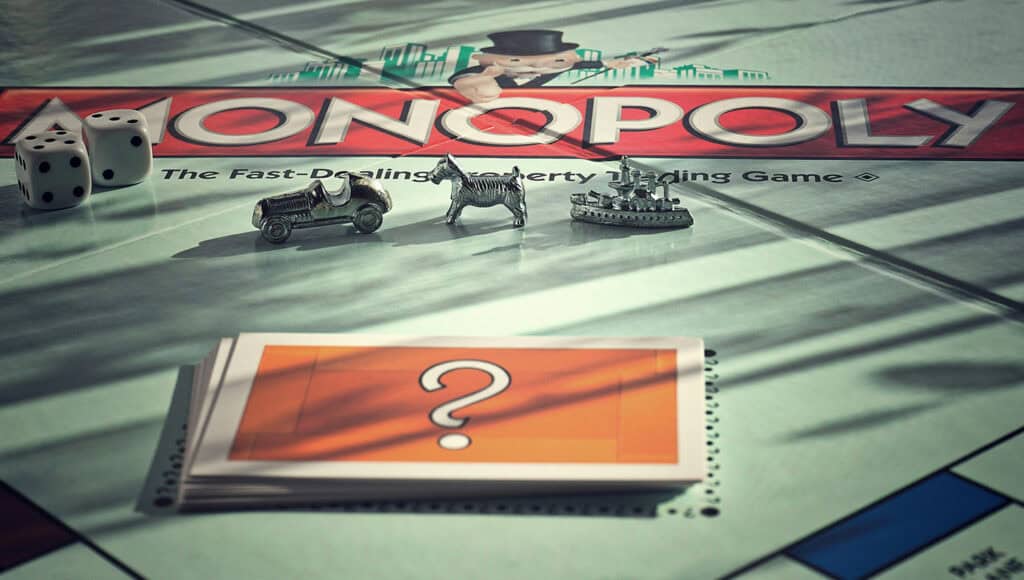

Games like Monopoly teach concepts like earning, spending, and saving in an engaging way. These games introduce the idea of planning finances, dealing with consequences, and handling risks, all while having fun with family or friends.

2. Savings Challenges

Give kids specific savings goals, like saving for a toy or book. Track their progress visually on a chart or board. This activity shows how consistent saving leads to achieving goals and encourages them to save rather than spend impulsively.

3. Coupon Clipping

Clipping coupons together teaches kids how to find deals and save money. It introduces the idea of budgeting and stretches their thinking about spending wisely. Kids can even “earn” a small part of the savings as an incentive.

4. Grocery Store Budget Challenge

Set a small budget and let kids select items during grocery shopping. This real-world exercise helps them learn about prices, decision-making, and staying within limits. They gain an understanding of value and cost while feeling responsible.

5. DIY Money Crafts

Kids can create their own play money, wallets, or piggy banks. It fosters creativity while reinforcing money concepts. These crafts also provide tools they can use in other money-related games or activities, making learning fun.

5 Money Activities for Preteens (Ages 11-13)

1. Allowance Budgeting

Teach preteens to split their allowance into categories like saving, spending, and donating. This introduces them to budgeting and financial planning, helping them prioritize and set financial goals.

2. Savings Journal

Keeping a journal of earnings, savings, and expenses builds accountability and planning skills. Preteens can set long-term financial goals and reflect on their spending habits, cultivating responsibility over time.

3. Toy Store Play (Advanced)

Turn pretend play into a mini “business.” Preteens can learn about pricing, inventory, and profits by selling items to family members. It’s a fun introduction to entrepreneurship and financial decision-making.

4. Grocery Store Budget (Advanced)

Allow preteens to plan and manage a family meal budget. They can research prices, make a shopping list, and purchase items, learning about cost-efficiency and decision-making in real-life scenarios.

5. DIY Wallet Projects

Preteens can design and create their own wallets from upcycled materials. This practical project encourages money organization and adds a personal, creative touch to their learning about managing finances.

5 Money Activities for Teens (Ages 14-18)

1. Creating a Budget Plan

Teens can practice tracking income, expenses, and savings. This teaches financial responsibility and helps them plan for future goals, like college or a car.

2. Mock Investing

Introduce teens to the stock market by setting up a virtual portfolio. This helps them understand investing and the risks involved.

3. Part-Time Jobs and Savings Goals

Encourage earning through part-time work. Pair it with setting savings goals to teach the value of money and hard work.

4. Comparative Shopping

Challenge teens to compare prices for items they want. This teaches cost-benefit analysis and smarter spending habits.

5. Credit Card Simulation

Explain credit and debt through a simulation. Teach how to manage payments and avoid financial pitfalls.

See also Lifestyle by Monthly Income: 6 Income Ranges Defined

How to Talk About Money Challenges with Kids

Talking about money challenges with children is essential to build financial literacy. Start by explaining the value of coins and money. Teach the difference between needs and wants through shopping activities.

Parents can share ideas about earning money and setting goals. Discuss basic financial management techniques and how a money investment plan works. Use relatable examples like saving for a toy. Encourage kids to think creatively about how to earn and manage money.

These conversations help children understand money’s role in life and build lifelong habits. Keep it simple and age-appropriate, ensuring children feel involved and capable.

Fun Family Money Activities

1. Board Games About Money

- Play games like Monopoly, Payday, or The Game of Life.

- These games teach financial concepts in an enjoyable way.

2. Family Budget Discussion

- Involve kids in planning the family budget.

- Discuss expenses and savings goals.

- This gives them real-world insights into money management.

3. Charity Project

- Choose a cause and raise money as a family.

- Kids learn the value of charity and giving back.

4. Coupon Clipping

- Teach kids to find and use coupons during shopping.

- It’s a practical way to introduce smart spending.

5. Savings Challenges

- Start a family savings challenge, like saving loose change.

- Set a fun reward when the goal is reached.

- This encourages teamwork and saving habits.

Benefits of Money Activities for Kids

- Develops Financial Literacy

Children understand the basics of saving, spending, and budgeting. - Builds Responsibility

Kids learn to take ownership of their money and decisions. - Encourages Goal-Setting

Activities like savings jars teach patience and long-term planning. - Prepares for the Future

Early money lessons make teens and young adults more financially confident.

See also Money Management Activities for Adults: 7 Fun Ways to Financial Success

Money Activities for Children: A Recap

Money activities for kids help teach financial literacy in a fun way. Encourage children to use money saving apps or a money savings tracker to manage their earnings. Provide free printables to make learning engaging.

Let kids handle paper money and coins for real-life practice. Small rewards like small toys can motivate them to save. Activities like investing games help kids understand the importance of growing money.

Teach them to set goals to save money for things they want. These hands-on methods develop important life skills while making learning enjoyable. Practical lessons on earning, saving, and spending prepare kids for the future. These experiences build confidence and instill lifelong money habits.