Ever found yourself overwhelmed by financial jargon and complex investment strategies? Imagine having a personal finance expert guiding you through every step of your financial journey.

Money management books are invaluable resources that simplify the complexities of personal finance, providing practical advice and proven strategies to achieve financial success.

These books are not just about numbers and budgets; they cultivate a positive money mindset, empowering individuals to make informed decisions and secure their financial future.

Reading money management books can transform your financial life. They enhance your financial knowledge, improve your money management skills, and provide strategies for reducing debt and increasing savings.

More importantly, they help you develop a mindset geared toward financial freedom and independence.

By the end of this article, you’ll have a curated list of essential money management books that will equip you with the knowledge and confidence to make sound financial decisions.

- Importance of Investment Books

- Money Management Books

- 1. Rich Dad Poor Dad

- 2. The Total Money Makeover

- 3. Your Money or Your Life

- 4. The Millionaire Next Door

- 5. I Will Teach You to Be Rich

- 6. Broke Millennial

- 7. The Richest Man in Babylon

- 8. Smart Women Finish Rich

- 9. Think and Grow Rich

- 10. The Automatic Millionaire

- 11. Financial Freedom

- 12. Secrets of the Millionaire Mind

- Money Management Books: A Recap

Here are 12 money management books:

- Rich Dad Poor Dad: Highlights the financial lessons learned from two different father figures, focusing on financial education and investing.

- The Total Money Makeover: A step-by-step guide to debt elimination, savings, and investing.

- Your Money or Your Life: Teaches how to align spending with values to achieve financial independence.

- The Millionaire Next Door: Reveals that ordinary people accumulate wealth through frugality and smart investing.

- I Will Teach You to Be Rich: A six-week program covering banking, saving, budgeting, and investing.

- Broke Millennial: Offers practical advice for millennials on managing money and tackling student loans.

- The Richest Man in Babylon: Uses parables to impart timeless financial wisdom on saving and investing.

- Smart Women Finish Rich: Focuses on financial planning and investment strategies for women.

- Think and Grow Rich: Outlines principles for achieving success through mindset, goal setting, and perseverance.

- The Automatic Millionaire: Advocates for automating finances to build wealth effortlessly.

- Financial Freedom: Provides advice on achieving financial independence through saving, investing, and side hustles.

- Secrets of the Millionaire Mind: Explores the mindset needed for financial success and wealth building.

See also Career and Wealth: Crafting a Fulfilling Career Path and Financial Wellness

Importance of Investment Books

Investment books play a crucial role in achieving long-term wealth by providing valuable insights and strategies essential for financial success.

These personal finance books offer a step-by-step guide to understanding complex financial concepts, making it easier to manage and grow wealth effectively.

By developing a positive money mindset through these resources, individuals can make sound financial decisions and avoid common pitfalls.

Furthermore, personal finance books provide strategies for saving money, investing wisely, and planning for retirement, which are key to achieving financial independence and freedom.

They also emphasize the importance of effective money management, ensuring financial wellness and peace. For young adults and others, these books offer practical advice on navigating financial challenges and promoting overall financial wellness.

Here are 10 benefits of reading money management books:

- Enhanced Financial Knowledge: Gain a deeper understanding of personal finance, budgeting, investing, and saving strategies.

- Improved Money Management Skills: Learn practical tips and techniques for effectively managing your income and expenses.

- Debt Reduction: Discover methods to pay off debts faster and more efficiently.

- Increased Savings: Acquire strategies to boost your savings and plan for future financial goals.

- Investment Insight: Understand the basics of investing, helping to grow your wealth over time.

- Financial Independence: Learn how to achieve financial freedom and reduce reliance on credit.

- Better Decision Making: Make informed financial decisions with confidence and clarity.

- Stress Reduction: Reduce financial stress by gaining control over your finances and planning for emergencies.

- Goal Setting: Set and achieve short-term and long-term financial goals effectively.

- Empowerment: Feel more empowered and confident in managing your financial future.

Money Management Books

Here is a list of popular and highly regarded money management books:

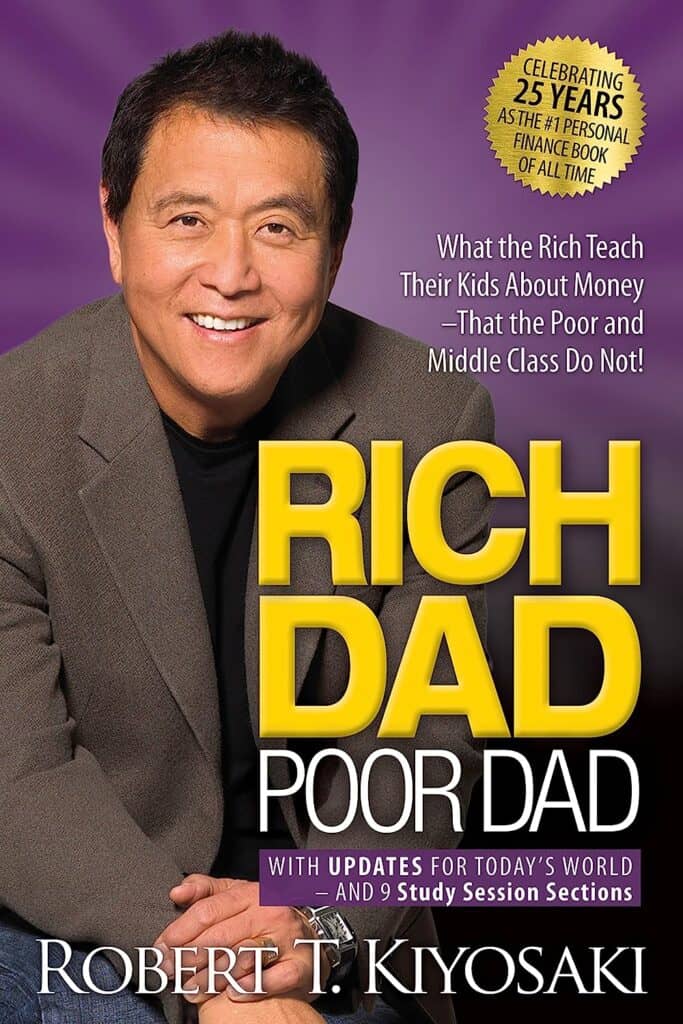

1. Rich Dad Poor Dad

“Rich Dad Poor Dad” by Robert T. Kiyosaki is a seminal personal finance book that imparts valuable lessons on building wealth.

Through the contrasting experiences of his “Poor Dad” (his biological father) and his “Rich Dad” (his friend’s father), Kiyosaki illustrates the mindset and strategies needed to achieve financial success.

The book emphasizes the importance of financial education, investing in assets like index funds, and creating passive income streams. It presents a simple path to wealth, advocating for a healthy relationship with money and proactive financial habits.

“Rich Dad Poor Dad” remains a cornerstone among money books, inspiring readers of all ages to pursue a rich life.

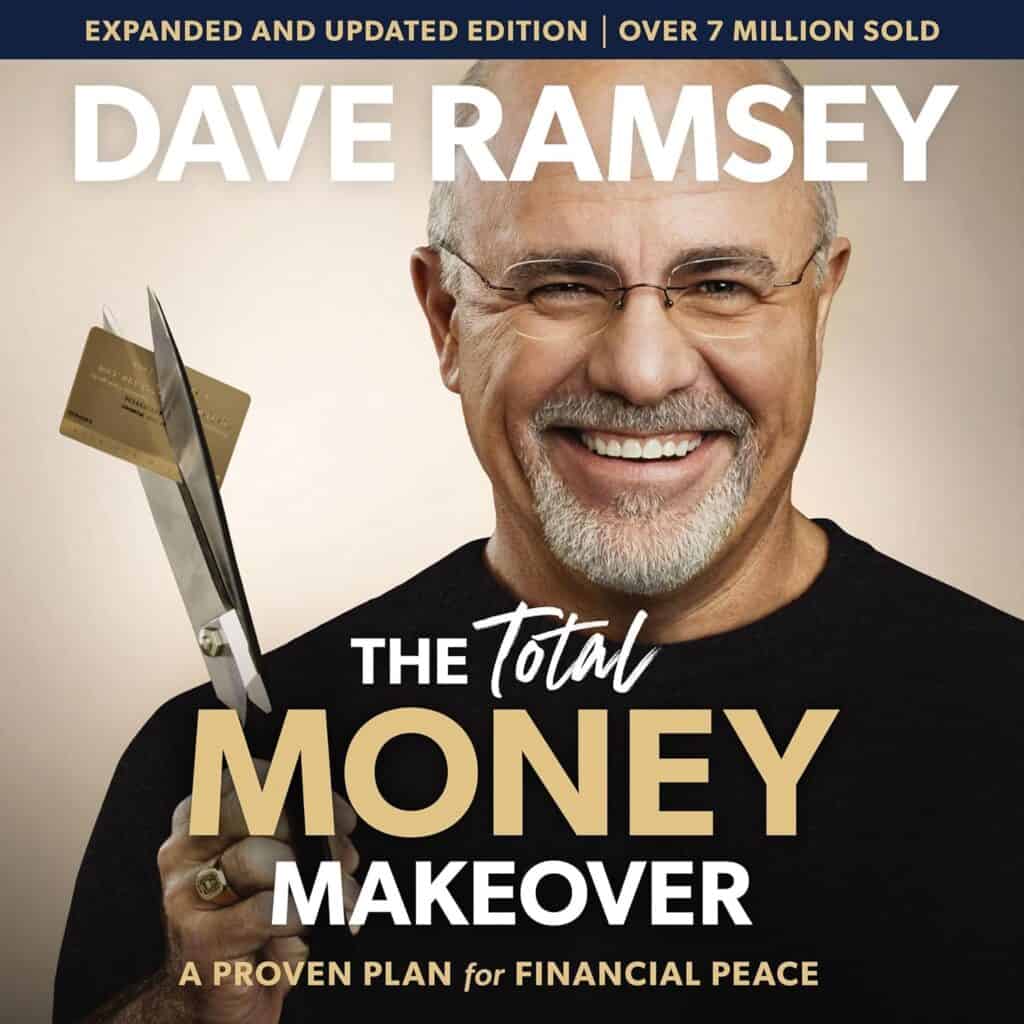

2. The Total Money Makeover

“The Total Money Makeover” by Dave Ramsey is a transformative personal finance book that offers a practical approach to financial education and planning.

Ramsey provides a step-by-step guide to managing money, tackling the biggest money challenges, and achieving financial sustainability.

Through his proven strategies, readers learn about debt payoff, effective budgeting, and smart investment strategies to build wealth. Ramsey’s straightforward advice helps individuals become intelligent investors, financial independence, and freedom.

With real-life money lessons and actionable steps, “The Total Money Makeover” empowers readers to take control of their finances, overcome financial hurdles, and secure a prosperous financial future.

See also Self-Love Books: 12 Books Nurturing Self Love and Inner Peace

3. Your Money or Your Life

“Your Money or Your Life” by Vicki Robin and Joe Dominguez is one of the best personal finance books, offering a comprehensive guide to money management and financial well-being.

This personal finance book focuses on transforming your relationship with money by teaching ten core money skills and effective strategies for debt management.

It emphasizes the importance of saving money, establishing an emergency fund, and achieving financial goals.

The book also explores value investing and offers practical tips for raising financially fit kids. Overall, “Your Money or Your Life” provides a total money makeover, guiding readers toward financial independence and a more fulfilling life.

4. The Millionaire Next Door

“The Millionaire Next Door,” by Thomas J. Stanley and William D. Danko, is a seminal work in personal finance that uncovers the habits and traits of America’s wealthy individuals.

This book reveals eight money lessons that emphasize the importance of positive money habits and frugality over flashy spending.

By examining the financial situation of the average millionaire, often a retired business executive, the authors provide insights into the psychology of money and financial health.

Celebrated among popular personal finance books, this work is praised by award-winning financial journalists for its practical advice on improving one’s financial life and achieving lasting wealth.

5. I Will Teach You to Be Rich

“I Will Teach You to Be Rich” by Ramit Sethi is a comprehensive guide aimed at achieving financial health and independence. Sethi blends the psychology of money with practical advice, making it accessible for both novice and advanced investors.

The book covers essential topics such as budgeting, investing principles, and creating enough passive income to reach financial independence.

Inspired by classics like “The Intelligent Investor” and “Smart Women Finish Rich,” Sethi’s approach is modern and straightforward, offering a one-page financial plan for easy implementation.

This book is ideal for those seeking financial wellness, peace, and the confidence to become financially independent.

6. Broke Millennial

“Broke Millennial” by Erin Lowry, explores topics like budgeting, saving, investing, and tackling debt. It offers relatable advice and real-life examples to help readers navigate the complex world of money management.

The book’s practical advice is relevant for both modern investors and those aspiring to be an automatic millionaire.

It emphasizes the importance of a healthy relationship with money and provides insights for advanced investors seeking to become financially independent.

This book is a must-read for anyone looking to gain financial wisdom and achieve financial success.

7. The Richest Man in Babylon

“The Richest Man in Babylon” by George S. Clason is a timeless classic among personal finance books, offering invaluable lessons on money management and wealth-building.

Through parables set in ancient Babylon, Clason teaches readers fundamental principles of financial success, emphasizing the importance of saving money, investing wisely, and living within one’s means.

This book provides a step-by-step guide to achieving financial freedom and building a positive relationship with money.

Much like “Smart Couples Finish Rich” by Erin Lowry and “Broke Millennial” by Erin Lowry, “The Richest Man in Babylon” offers practical advice for making more money, breaking the cycle of financial struggle, and attaining financial peace.

8. Smart Women Finish Rich

“Smart Women Finish Rich” by David Bach is a financial guide tailored to empower women to achieve financial independence.

Drawing from the principles of “The Millionaire Next Door” and “Your Money or Your Life,” Bach addresses the psychology of money and provides practical advice on building wealth.

The book emphasizes the importance of establishing an emergency fund, managing debt, and adopting sound investing principles.

Through Bach’s insights and strategies, smart women can navigate financial challenges, reach financial independence, and embrace their role as financial feminists.

With “Smart Women Finish Rich,” readers gain the knowledge and confidence to take control of their finances and secure a prosperous future.

9. Think and Grow Rich

“Think and Grow Rich” by Napoleon Hill is a timeless classic that outlines a simple path to wealth and financial freedom. Hill distills the psychology of money into a nine-step program, emphasizing the importance of mindset in making money.

Through insightful tips and practical advice, he explores concepts like debt management, saving money, and intelligent investment strategies.

Hill’s book serves as a foundational text in personal finance, offering readers a one-page financial plan and empowering them to take control of their financial futures.

With its focus on the psychology of money and proven financial principles, “Think and Grow Rich” remains one of the best personal finance books for those seeking to reach financial independence and build lasting wealth.

10. The Automatic Millionaire

“The Automatic Millionaire” by David Bach is widely regarded as one of the best personal finance books, offering a simple path to financial freedom.

Bach, an intelligent investor, shares insights on debt management, setting financial goals, and reaching financial independence through actionable advice.

The book emphasizes the importance of automated savings, making it an excellent personal finance resource for those seeking to achieve financial freedom.

It also provides guidance on raising financially fit kids and age-appropriate activities to instill money-saving habits.

With its focus on clever strategies and practical tips, “The Automatic Millionaire” is a valuable resource for individuals looking to save money and achieve long-term financial security.

11. Financial Freedom

“Financial Freedom” by Grant Sabatier explores the psychology of money, offering insights into making money work for individuals rather than being enslaved by it.

This book, often regarded as one of the best personal finance books, emphasizes the importance of financial planning and debt management.

It provides a one-page financial plan for clarity and simplicity in achieving financial goals, making it a valuable resource for those seeking financial freedom.

With a focus on the stock market bible and strategies to save money, “Financial Freedom” equips readers with the knowledge needed to become intelligent investors and master the art of personal finance.

12. Secrets of the Millionaire Mind

“Secrets of the Millionaire Mind” by T. Harv Eker explores the mindset and habits of wealthy individuals, offering insights on how to replicate their success. Eker explores the psychological factors behind financial success, highlighting the importance of mindset in wealth accumulation.

Drawing on his experiences and those of others who have reached financial independence, Eker provides actionable strategies for making money and achieving financial freedom.

The book challenges readers to examine their beliefs and attitudes toward wealth, guiding them toward a mindset conducive to prosperity.

It serves as a practical guide for aspiring investors, akin to the wisdom imparted by Benjamin Graham’s “The Intelligent Investor.”

See also Personal Growth Stories: 7 Stories of Strength and Empowerment

Money Management Books: A Recap

In conclusion, exploring the diverse array of money management books offers invaluable insights into personal finance and wealth-building strategies.

From the practical advice of the “Broke Millennial” to the empowering principles of the “Financial Feminist,” these resources cater to various financial goals and lifestyles.

Award-winning financial journalists and renowned experts share their expertise, providing readers with the knowledge and tools to navigate the complexities of personal finance.

Whether seeking investment strategies, raising financially fit kids with “Clever Girl Finance,” or mastering the basics of money management, these books offer actionable guidance for individuals at every stage of their financial journey.

By incorporating the wisdom gleaned from these personal finance books, readers can empower themselves to achieve financial security and unlock their full potential for financial success.